海南拼多多电商运营培训哪里有

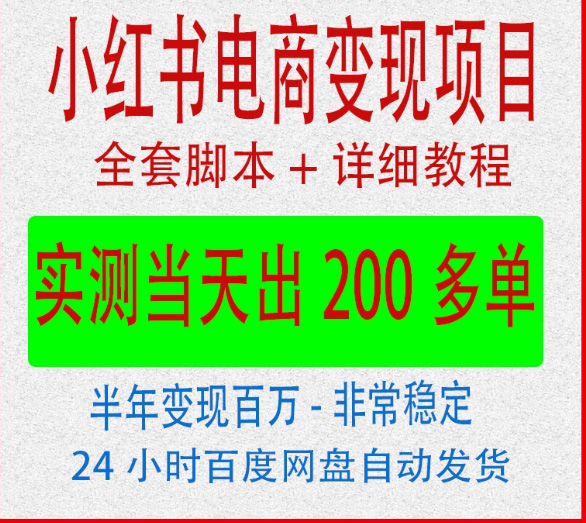

小红书电商变现培训

对电商平台而言,代运营商一方面能为平台引入国内外优质品牌,提升平台的知名度,进而拉动用户流量。另一方面,代运营商所创造的GMV本身也是平台交易量的重要支撑。For e-commerce platforms, on the one hand, proxy operators can introduce high-quality domestic and foreign brands to the platform, enhance its visibility, and thereby drive user traffic. On the other hand, the GMV created by proxy operators is also an important support for platform transaction volume.

过去快时尚的定位介于高端品牌和大众品牌之间。如今,快时尚正向高性价比产品以及以及高端品牌的两端延伸。前者是电商平台以价换市场的体现,后者则是传统快时尚品牌应对竞争,维持增长做出的必要选择。

快时尚是最适合电商自营的品类。快时尚毛利率超50%,远超普通消费品(20%),是给电商自营带来最大利润回报的品类。更重要的是,快时尚讲究快迭代,电商平台靠着数据优势,能对潮流迭代作出更好的预测。Fast fashion is the most suitable category for e-commerce self operation. Fast fashion has a gross profit margin of over 50%, far exceeding that of ordinary consumer goods (20%), and is the category that brings the greatest profit return to e-commerce self operation. More importantly, fast fashion emphasizes fast iteration, and e-commerce platforms rely on their data advantages to make better predictions for trend iterations.

后者典型案例则为宝尊与丽人丽妆。2022年,宝尊净亏损超一半来自公允价值变动损失,达3.648亿元。在2021年,阿里旗下菜鸟智慧物流以2.179亿美元收购了宝尊旗下从事仓储和配送的子公司宝通股份30%股权。根据当时的协议,倘发生若干触发事件,菜鸟有权要求宝尊以相等于初始投资的价格加上每年6%的内部回报率赎回其股份。The typical cases of the latter are Baozun and Beauty Beauty. In 2022, over half of Baozun's net loss came from changes in fair value, reaching 364.8 million yuan. In 2021, Alibaba's Cainiao Smart Logistics acquired a 30% stake in Baotong, a subsidiary of Baozun engaged in warehousing and distribution, for $217.9 million. According to the agreement at the time, if several triggering events occur, Cainiao has the right to request Baozun to redeem its shares at a price equal to the initial investment plus an annual internal return rate of 6%.

不仅市场规模庞大,快时尚服装的利润也远高于其它消费品。ZARA的母公司Inditex、H&M毛利率常年在50%以上。而大众快消品毛利率普遍在20%左右。这意味着,电商平台发力快时尚获得的利润要远比发力其他商品高。HEIN specializes in fast fashion, cost-effective women's clothing, and currently covers over 220 countries and regions. Looking at the development of SHEIN, its growth rate can be compared to the overseas version of Pinduoduo. In 2022, SHEIN's revenue was $22.7 billion, a year-on-year increase of 52.8%. In 2020 and 2021, SHEIN's revenue grew at a year-on-year rate of 211% and 60%. From 2014 to 2020, SHEIN achieved 100% year-on-year growth for six consecutive years.