阳江拼多多电商运营培训多少钱

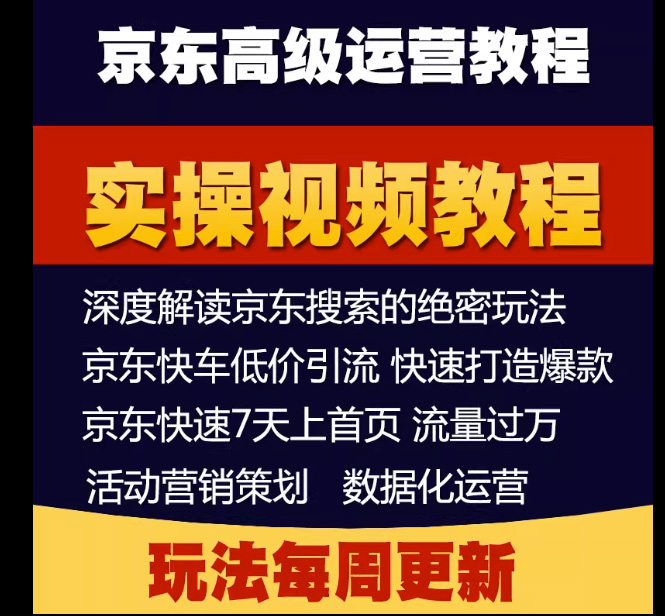

京东电商培训运营

另一个原因则源于内部的扩张思路,电商代运营企业正在消化非经常性损益带来的短期业绩波动。头部代运营商的扩张思路,主要可分为两类:一是通过花钱投资孵化或并购新品牌,二是通过资本化手段,投资或参股企业,通过公允价值变动收益优化利润表。Another reason is due to internal expansion thinking, as e-commerce operators are digesting short-term performance fluctuations caused by non recurring gains and losses. The expansion ideas of top generation operators can be mainly divided into two categories: one is to incubate or acquire new brands through investment, and the other is to optimize the income statement through capitalization means, investment or equity participation in enterprises, and changes in fair value income.

这几年,许多电商平台开始加入销售生鲜水果大军,越来越多的消费者选择从电商渠道购买水果。但最近有媒体报道,一位业内人士接受采访时称,果园出品的有伤的残次果,很难在传统渠道销售,一般以低价转卖给电商平台的商户,被业内叫“电商果”。在相关报道的留言区,也有网友吐槽此前在电商平台买水果的经历,甚至有人把报道中的“电商果”与劣质水果简单地划上了等号。Not only is the market scale huge, but the profits of fast fashion clothing are also much higher than other consumer goods. The gross profit margin of ZARA's parent companies Inditex and H&M is consistently above 50%. The gross profit margin of Volkswagen's fast moving consumer goods is generally around 20%. This means that the profits obtained by the e-commerce platform Fali Fast Fashion are much higher than those of other Fali products.

还有一类是考虑到本土化经营的外资品牌,直到如今它们依旧偏爱代运营商。强生、美赞成背后的若羽臣;爱茉莉(太平洋)、花王集团、LG集团背后的丽人丽妆;耐克、星巴克、三星背后的宝尊.Another type is foreign brands that consider localized operations, and even now they still prefer proxy operators. Johnson&Johnson and Mei agree with Ruoyuchen behind the scenes; The beauty makeup behind Amory (Pacific), Flower King Group, and LG Group; Behind Nike, Starbucks, Samsung

用一个可能不太恰当的比喻来形容代运营商的发展历程,其实就是想从“乙方”变“甲方”,想翻身农奴把歌唱。但为何变身之路如此困难?问题的关键出在了商业模式的设计上。To use a potentially inappropriate metaphor to describe the development process of proxy operators is actually to transform from "Party B" to "Party A", and to become a serf and sing. But why is the path of transformation so difficult? The key to the problem lies in the design of the business model.

投资界有一个“黄金三角”理论,判断一个企业是否具备成长性,主要看三点:好时机、好赛道与好公司。好时机能够帮助企业赢得时间窗口,取得一定的先发优势;好赛道能吸纳足够的“钱”景,享受估值溢价;好公司则以好的商业模式实现稳健的经营。There is a "Golden Triangle" theory in the investment community, which judges whether a company has growth potential mainly based on three points: good timing, good track, and good company. Good timing can help enterprises win the time window and gain a certain first mover advantage; A good track can absorb enough 'money' and enjoy a valuation premium; Good companies achieve stable operations with good business models.