三门峡拼多多电商培训课程

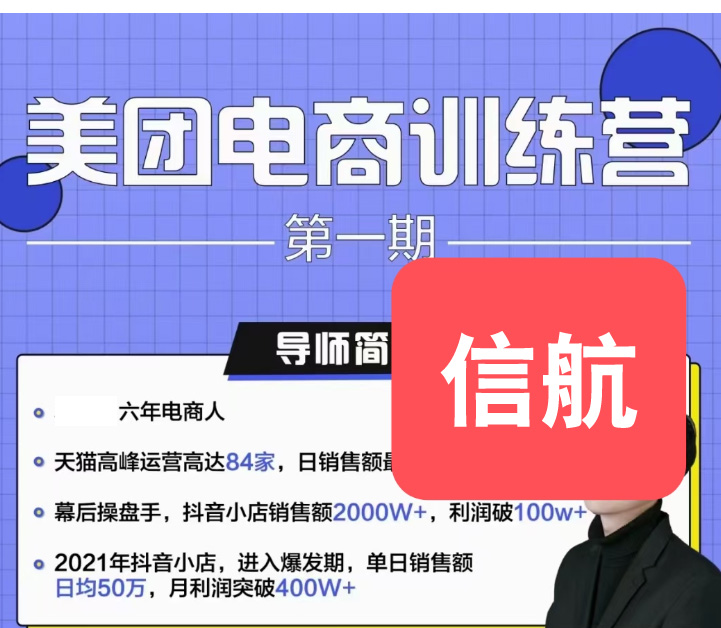

美团电商培训课程

电商平台对传统快时尚品牌形成了全方位优势。在潮流预测中,电商反应速度、上新速度远高于传统快时尚企业。ZARA一年的新品上新量仅相当于SHEIN一个月的上新量。而在价格上,电商靠更柔性的供应链生产模式,大多数产品的价格能做到快时尚品牌的一半。E-commerce platforms have formed a comprehensive advantage over traditional fast fashion brands. In trend forecasting, e-commerce has a much faster reaction speed and faster update speed than traditional fast fashion enterprises. ZARA's annual new product launch is only equivalent to SHEIN's monthly launch. In terms of price, e-commerce relies on a more flexible supply chain production model, with most products priced at half that of fast fashion brands.

投资界有一个“黄金三角”理论,判断一个企业是否具备成长性,主要看三点:好时机、好赛道与好公司。好时机能够帮助企业赢得时间窗口,取得一定的先发优势;好赛道能吸纳足够的“钱”景,享受估值溢价;好公司则以好的商业模式实现稳健的经营。There is a "Golden Triangle" theory in the investment community, which judges whether a company has growth potential mainly based on three points: good timing, good track, and good company. Good timing can help enterprises win the time window and gain a certain first mover advantage; A good track can absorb enough 'money' and enjoy a valuation premium; Good companies achieve stable operations with good business models.

过去快时尚的定位介于高端品牌和大众品牌之间。如今,快时尚正向高性价比产品以及以及高端品牌的两端延伸。前者是电商平台以价换市场的体现,后者则是传统快时尚品牌应对竞争,维持增长做出的必要选择。

还有一类是考虑到本土化经营的外资品牌,直到如今它们依旧偏爱代运营商。强生、美赞成背后的若羽臣;爱茉莉(太平洋)、花王集团、LG集团背后的丽人丽妆;耐克、星巴克、三星背后的宝尊.Another type is foreign brands that consider localized operations, and even now they still prefer proxy operators. Johnson&Johnson and Mei agree with Ruoyuchen behind the scenes; The beauty makeup behind Amory (Pacific), Flower King Group, and LG Group; Behind Nike, Starbucks, Samsung

数据显示,2021年我国生鲜电商行业市场规模已经超过3000亿元,水果作为生鲜农产品的重要类别,其在电商销售渠道的占比也在日益增加。但归根到底,平台方要想在水果电商市场“分一杯羹”,还需建立严格的平台审核机制,用消费者满意的品质和服务说话,这也是其长远发展下去的动力。商家也应意识到,要想维持住销售流量,赢得消费者口碑,还应用心守住收购、包装和发货等每个环节,才能以稳定的供货品质打响自己的招牌。其实一些电商销售平台也有好的经验和做法,比如要求入驻商家在商品界面标明各类水果的大小、磕碰、成熟度情况等影像信息,重点提示水果外观存在问题等,让消费者了解果质后下单,免去了收货后“货不对板”的风险,在这些商品的留言区也是好评居多。这也证明,只要确保水果质量,让消费者与商家在水果品质上达成信息对称,不管是瞄准哪个消费渠道的水果,都能实现其应有的价值。Data shows that the market size of China's fresh e-commerce industry has exceeded 300 billion yuan in 2021, and fruits, as an important category of fresh agricultural products, are also increasing in their proportion to e-commerce sales channels. But ultimately, if the platform wants to "get a piece of the cake" in the fruit e-commerce market, it still needs to establish a strict platform review mechanism, speak with consumer satisfaction of quality and service, which is also the driving force for its long-term development. Merchants should also realize that in order to maintain sales flow and win consumer reputation, they should also carefully guard every link such as acquisition, packaging, and shipping, in order to establish their own brand with stable supply quality. In fact, some e-commerce sales platforms also have good experience and practices, such as requiring merchants to indicate the size, bumps, maturity, and other image information of various fruits on the product interface, with a focus on reminding consumers that there are problems with the appearance of the fruits, so that consumers can understand the quality of the fruits before placing an order, avoiding the risk of "wrong products" after receiving them. These products are also highly praised in the message area. This also proves that as long as fruit quality is ensured and consumers and merchants achieve information symmetry in fruit quality, regardless of which consumption channel the fruit is targeted at, it can achieve its due value.